Loading...

Loading...

Learn about trading and investing in Cryptocurrencies, Altcoins, Top Crypto Exchanges, Indicators. Learn how to Trade BTC, ETH and other cryptocurrencies.

Join the #1 Crypto Community in the World

Company

Copyright © 2026 WEB THREE LEARNING LTD, All rights reserved.

Master the art of cryptocurrency with our in-depth guides and learn all the basics as well as the advanced lessons of blockchain.

Pump and dump schemes attracted a lot of attention in recent years due to the expansion of the cryptocurrency market. Specifically, with the bull market experienced in 2017 and several Initial Coin Offering (ICOs) tokens being released on a daily basis, scammers used these schemes in order to make fast and easy money (at the expense of other traders losing their investment).

In this guide, we will discuss what pump and dump schemes are, and how to avoid them.

Trading techniques used by scammers to make fast money at the expense of other traders’ money. They do not only work in the cryptocurrency market but can also happen with small stocks and assets.

These pump and dump schemes take place on social media, generally through private Telegram groups or VIP groups in Discord. The owners of these groups would push the price of specific assets higher and provide buying recommendations to users that do not have enough knowledge on the subject.

The organizers of these pump and dump schemes would be purchasing the virtual currency (or any other stock) at very low prices (when it is not known yet), promote and recommend it later to a large user base through private Discord and Telegram groups.

As members of the trading groups will start acquiring and buying these assets, its price would move higher. Considering this would attract more investors, the market would enter a vicious cycle where the perpetrators of these pump and dump schemes would be benefited the most.

Once the price reaches very high levels, the owners of these groups will sell their cryptocurrencies and see the price fall. Due to the fact the coins pumped have low liquidity, as soon as large amounts of coins are sold, the price will fall faster than what it grew. This would leave a large number of investors with large bags of coins without value or for a lower price than when they acquired them. Some of them will have to sell their coins at a loss.

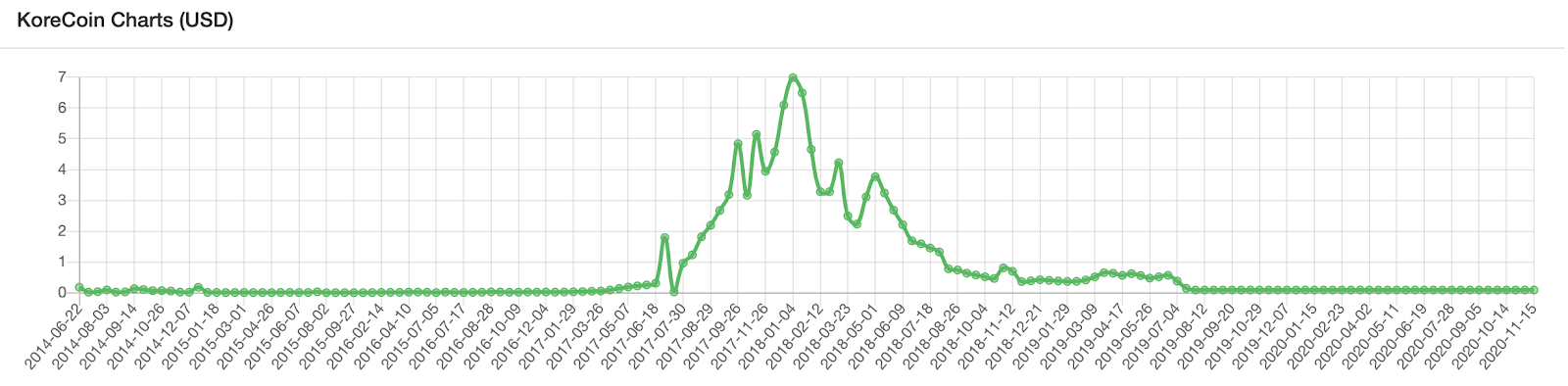

One of the examples is the one seen in the image above. KoreCoin was pumped from $0.31 to $1.79 in just a few days. In just 15 days after reaching $1.79, the price fell to $0.02, less than the initial price of the pump and dump. However, after it, another pump and dump started and lasted for several months until the cryptocurrency disappeared.

It is worth taking into consideration that some users were already warning others about a possible pump and dump in Korecoin.

This is a list of things you can do to avoid pump and dump schemes in cryptocurrencies.

If this is your first semester at CryptoGuide, we recommend starting at the beginning and working your way through this guide.